How Verisave Helps Reduce, Manage and Control Merchant Account Fees

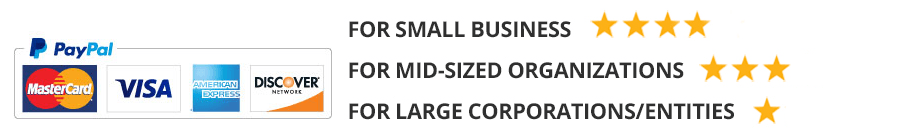

At Verisave, we specialize in helping businesses lower their monthly merchant account fees. With years of experience and back-end knowledge of the credit card industry, we managed to secure $5.3 million in savings just last year for our clients. Too many companies are letting their merchant account fees get the best of them, paying high interchange rates, late fees, and other unnecessary charges. Human errors can be made due to the complexity of merchant account statements. Bringing Verisave on board provides businesses with a three-fold service of ongoing reduction, management, and control of company merchant account fees

.