Worldpay for Credit Card Payment Processing

Worldpay offers credit card processing services in 40 different countries across the globe. Since Worldpay’s merger with Vantiv in 2017, their global presence has grown to include businesses of all sizes with the Vantiv side catering better to small business and Worldpay working better for larger corporations.

Considering their broad reach across the world, we’ll be reviewing Worldpay as it pertains to US merchants. This includes merchants operating from within the US, selling to a US customer base, and US business owners selling to a global market as well.

It should also be noted that for small to medium-sized businesses, the Worldpay website redirects these customers to Vantiv.

Verisave customers achieve an average savings of 25%-35% in overall credit card processing fees with an audit from Verisave. If you are interested in working with Worldpay, restructuring with Worldpay, or just looking to save on merchant costs, then speak with a Verisave merchant service expert.

Merchant Credit Card Processing Products & Services

While companies of this size have leaned toward developing a large set of business management tools to help with data reporting, inventory management, and much more, Worldpay primarily focuses on payment processing. They offer the following merchant tools:

WORLDPAY PAYMENT PROCESSING SERVICES: When establishing your account with Worldpay for payment processing, you’ll be set up with a POS system, necessary software, data security, reporting tools, and a payment gateway.

WORLDPAY POS TERMINALS: Worldpay offers proprietary POS systems as well as options for using a variety of third-party POS systems that integrate with their software. With Worldpay, you have the option of using virtual terminals (eliminating the need for a POS station), mobile terminals (phones and tablets), or standard POS systems. The Worldpay website advertises:

Integrated POS – processing technology built into the POS system

Terminals – another way to enjoy Vantiv service and support

Virtual terminal – when you are away from your store

Ecommerce – easy, online transactions to extend your reach

Mobile payments – accept mobile payments and capture more sales

Choose from the following POS terminals:

- Verifone Vx520

- Ingenico iCT220

- Ingenico iCT250

WORLDPAY MERCHANT ACCOUNTS: Combine your merchant account provider with your payment processor with Worldpay. Benefits to this include the ability to make one phone call for payment disputes instead of multiple phone calls.

WORLDPAY ENTERPRISE SPECIFIC PROCESSING PLANS: Worldpay has developed specific processing solutions for niche-specific enterprises. These plans involve combinations of multiple business tools paired with credit card payment processing and more. POS systems, gift cards, loyalty programs, payment processing, analytics and more come in these customized plans and will vary based on the specific needs of your industry.

- Airlines

- Grocery and Drug Stores

- Restaurant Chains

- Education

- Nonprofit

- Retail

- Fuel and Convenience Stores

- Public Sector

- Travel

- Online Subscriptions

- eCommerce Marketplaces

- Social and Dating Websites

- Software Sales and Services

- Video Game Development and Sales

WORLDPAY OMNI-CHANNEL PAYMENT ACCEPTANCE: Merchants using Worldpay services can accept payments using any of these available methods:

- In-store

- Online

- Offsite

- EMV

- Apple Pay

- Samsung Pay

- Android Pay

- Credit and Debit cards

- Gift cards

- eChecks

- eCommerce shopping carts

- Traditional POS systems

- Virtual terminals

- Mobile POS

WORLDPAY ONLINE DATA REPORTING SOLUTION: Compile reports to better understand clear data sets for credit card processing information (reconciliation, interchange management, fees, fraud, exception handling, etc).

WORLDPAY eCOMMERCE SOLUTION: On your eCommerce site, you can accept any form of payment. Track customer purchasing habits to improve your sales. The eCommerce solution from Worldpay also caters to fraud protection with proprietary encryption and tokenization.

WORLDPAY DATA SECURITY: By providing POS systems that accept EMV (chip card) card readers, you’re adding an extra measure of security to your customers’ purchases as well as your sales. Allowing customers to use an EMV card in your store helps to protect you from counterfeit cards. Worldpay’s in-flight data encryption and tokenization make their data more secure as it moves from entity to entity, deterring hackers with unreadable information.

Other Business Management Solutions Offered by Worldpay:

Loyalty programs and gift cards

Optimization

ATM services

We can apply our proven savings strategies to your Worldpay merchant account to lower your overall fees. Working with Verisave is all the customization you will need for managing your merchant accounts with Worldpay. If Worldpay is not the best option for your business, we will tell you who is. Give us a call before making long-term commitments to any credit card payment processor.

Worldpay POS System Integration

Worldpay offers a basic array of payment processing tools for merchants. These systems are easy to integrate into a current system, or if you’re starting from the ground up, they’re even easier to get started with. They offer traditional POS systems that most business owners and customers are already familiar with so the learning curve is low with Worldpay’s hardware and software.

If you currently have your own POS system that you would like to continue using, check to see if Worldpay’s software is compatible with your system.

How Much Will You Be Paying For Worldpay Credit Card Processing?

Worldpay contracts include long terms (3 years), high cancelation fees, an auto-renewing clause, and monthly compliance fees. These are significant factors to consider when comparing Worldpay to other processing companies. An early termination fee for Worldpay can range from $95 to $495 depending on your circumstances. Their PCI compliance fees are also higher than the industry average ranging from $15 to $25 each month. Other miscellaneous fees reported by disgruntled customers include an annual $69 fee for tax reporting and unexpected monthly account service fees.

Regardless of what you read online, each merchant will have a slightly different experience. Speaking directly with a sales rep is the first step to take when considering Worldpay services. They will ask you a series of questions to create a quote. Variables considered include:

- Average monthly processing volumes

- Business industry

- Primary mode of payment acceptance

- Customizable plan options

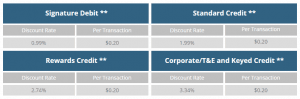

While Worldpay offers little information on their website concerning pricing, they do advertise the following rates as a starting point:

Of course, these rates will change once you’ve spoken with a sales rep.

Verisave has worked with hundreds of companies using large credit card processors including Worldpay and we are confident our auditing experts can help you to lower your overall merchant fees. While Worldpay has a high complain volume of hidden and miscellaneous fees, Verisave merchant account experts are capable of saving you 25% to 35% in your overall merchant account expenses. Contact us today to start this simple process with a free analysis of your current merchant account statement.

Contract Lengths For Worldpay Payment Processing and Business Management Solutions

Like many credit card processors, Worldpay has a standard contract length of 3 years. If you cancel services before the term of your contract length has been met, you can expect an early termination fee that is anywhere from $95 to $495.

Though this has been standard practice for credit card processors and merchant account providers throughout the history of credit and debit cards, it’s slowly changing to meet the needs of today’s market. More and more processors are eliminating long-term contracts or at least offering month-to-month commitments to make things more suitable for merchants. If you’re interested in a shorter term contract, we can suggest a number of reliable processors that offer this feature.

Working With Worldpay’s Sales and Customer Service Reps

Researching Worldpay’s Merchant Services – Merchants can acquire Worldpay services either directly through the company or third-party retailers. Depending on the route you choose, you’ll have a different experience. Often third-party retailers can offer lower fees, but they are limited to the services they can offer. If you sign up with Worldpay directly through the company, your process will be more standard with set pricing and a full menu of their credit card processing services and business management tools.

A sales rep direct from the company should ultimately be more reliable than a third-party reseller. When working with an ISO or an independent sales rep, you’re likely to find that some are very transparent while others are less likely to paint a clear picture for you. This could be a big contributor to the negative reviews found online concerning unexpected charges, termination penalties, higher rates, and other unexpected costs.

Another complaint we have come across concerning the sales process for Worldpay is misleading offers. One such offer was a “free” terminal which turned out not to be true. We don’t think this reflects well on the business as a whole.

Contacting Worldpay’s Customer Support – Many, many complaints have been issued against Worldpay’s customer support. But this can be expected for a company processing nearly $1.5 trillion annually. Even a few hundred complaints is a small number in comparison. They have many available support lines for merchant services and the many business management solutions they offer. But even though Vantiv and Worldpay are now working as a team, their sales and customer services channels are entirely separate.

You can access Worldpay customer support via phone, email, contact form, and live chat. They also host forums and supply a library of readable resources on their website for troubleshooting.

Online Reviews of Worldpay

Worldpay is not a highly favored credit card processor according to popular reviews from major sites like Merchant Mavericks, Credit Card Processing Net, and Trustpilot. While Worldpay has an extensive reach, a plethora of business management solutions, and a streamlined system for processing, this large corporation falls short when it comes to customer service. That doesn’t make it a bad company to work with though. It’s a go-to processor for companies looking for a one-stop solution as they offer such a wide variety of customizable services.

You can avoid frustrations commonly experienced when dealing with Worldpay’s customer service by working with merchant account experts at Verisave. From the initial onboarding process to monthly management of your merchant account, we can help you to pay lower overall merchant fees and monitor activity to maintain costs through the life of your contract. Having worked with a number of companies using Worldpay for credit card payment processing, we know what to expect from Worldpay’s contractual agreements, fees, and miscellaneous charges. Truly hand off this side of the business to a trusted team of merchant account experts so you can turn your focus to more favorable aspects of running your company.

VERISAVE MERCHANT SERVICES REVIEW

Worldpay for Credit Card Payment Processing

While we might not promote Worldpay as a cure-all for merchants of all industries, they are a suitable company for some. Long contract lengths, miscellaneous fees, early termination penalties are common across the board when it comes to credit card processing. Complaints concerning these issues with Worldpay are hardly uncommon. The key to having a successful working relationship with your credit card processor is education – developing a better understanding of the credit card processing industry.

Verisave has worked with 500+ merchants to drastically lower their credit card processing fees. This has led our team of experts to develop proprietary benchmark data for tracking and comparing which fees can be audited for refunds and savings with current market trends. Based on our experience with numerous processors, gateways, and credit card providers – and now having an invaluable data set of industry statistics – our clients gain control over the confusion of the credit card industry and save money. Watch the video below to see how our trusted process works:

Whether you are currently working with Worldpay or if you’re just exploring your options, our experience in the credit card processing industry lends a considerable leg up to merchants in any industry. Contact us today to start the process of uncomplicating your merchant statement and lowering your overall monthly merchant fees.