Lower credit card processing fees without changing processors.

Most businesses are being overcharged within their merchant account. They often believe that there is only one way to achieve lower credit card processing fees: change processors.

This is often a mistake. It’s typically best to stay with the processor you already have.

Verisave simplifies your existing merchant account.

Credit card processing fees are complex ON PURPOSE. The industry is made up of numerous banks, card-brands, and processors … and all of them influence the fees businesses pay.

To lower these fees, you need extensive expertise, insider knowledge, and mountains of industry benchmark data.

Verisave has you covered.

We will optimize your merchant account and fix every error and overcharge … without any need to change processors.

And you don’t pay us a dime until we bring that money back to you.

Identifying the problem.

You have very little control over your merchant account credit card processing fees.

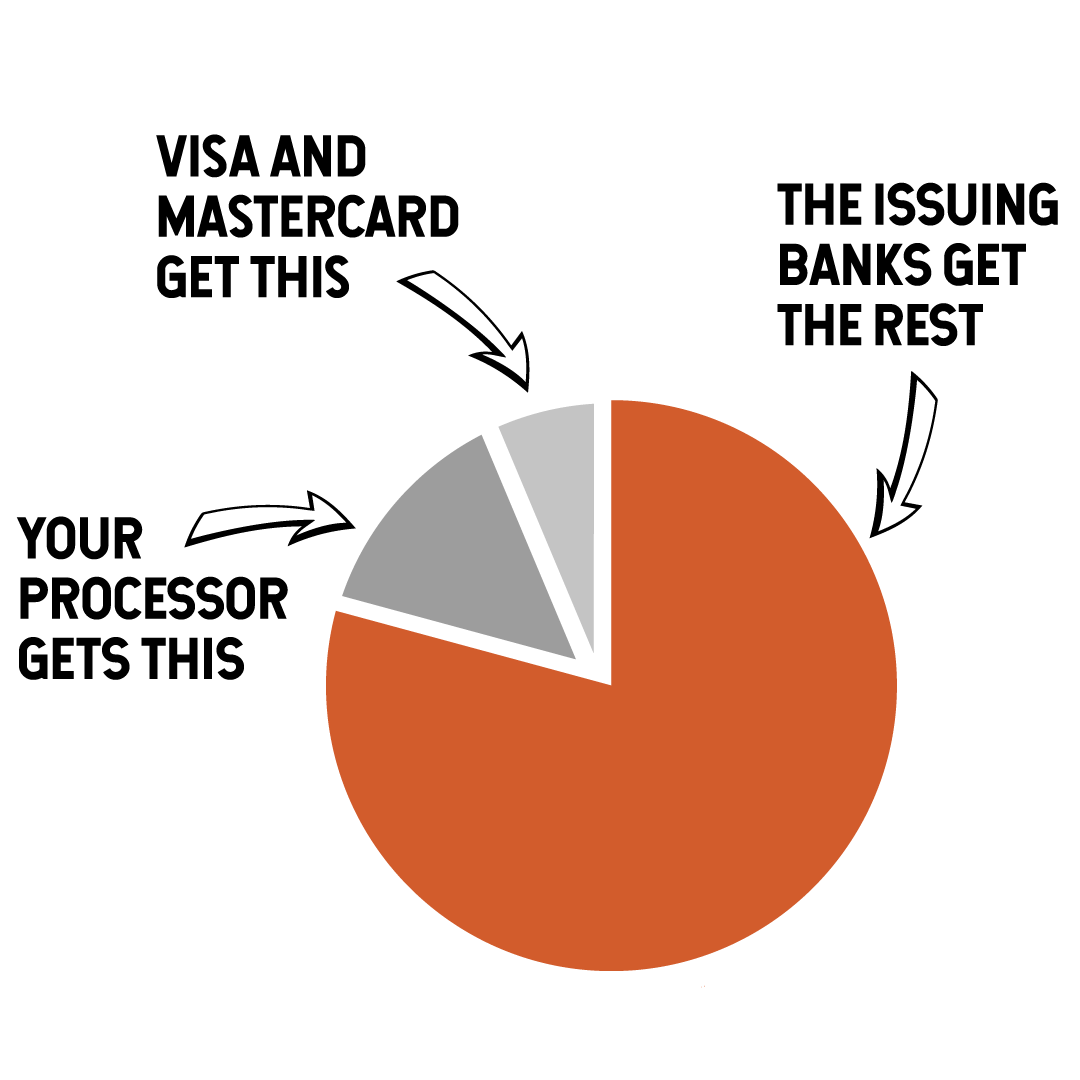

Yes, you have a direct relationship with your merchant processor. But only a small amount of the credit card processing fees you pay go to that processor. Most go to the bank that issued the credit card … and you have no leverage with that bank.

Most of their fees go to the bank that issued the credit card to your customer … and they have no leverage with that bank.

These are called INTERCHANGE FEEs. And they can be lowered.

Verisave processing fee optimization.

Many merchants recognize that they’re losing money on credit card processing fees, but they don’t have the expertise to identify where it’s happening or how to fix it.

With Verisave’s proprietary process:

- You get full transparency of your merchant processing fees

- Your account is optimized to the lowest possible rate

- You receive all applicable industry or card-type discounts

- We can even lower your interchange fees

- We do all of the work for you

Taken together, the result is SUBSTANTIAL savings in the credit card processing fees you pay, with no risk or effort on your part. You can even keep your current processor.

All we need to get started is a recent merchant account statement. Within days, we’ll run an initial analysis, and report back to you with our findings. No charge, and no obligation.

Average Fee Reductions:

10-30%

How Verisave reduces your processing fees:

Verisave offers cost-reduction, simplified. With minimal time investment, disruption, risk, or upfront fees, we can easily bring 10%-30% of your credit card processing fees back to your bottom line.

No need to change processors, and no need to add a project to your team’s workload.

Strategy

We dissect and analyze every fee on your merchant account to find all viable savings tactics, re-classifications, and hidden discounts.

Optimization

We apply these tactics to your existing merchant account, implementing all savings for you. We do all of the work.

Monitoring

We monitor the account every month to ensure your fees do not increase over time, and that any annual rate updates are minimized or avoided.