Every year in April and October, the card brands update processing rates and rules. Verisave has been monitoring developments and has summarized the rate and rule changes that will impact the broadest number of merchants.

In addition to introducing new fees and rules, Visa is introducing a new fraud mitigation tool – Account Name Inquiry.

New Fees From Visa

New Digital Commerce Services Fee – US

Effective October 1, 2023, Visa began assessing a new Commerce Services Fee of 0.0075% (with a minimum of $0.0075) on all settled card-not-present transactions. This fee will include access to the following services, which Visa will no longer bill for in the US: Address Verification Service (AVS), Card Verification Value 2 (CVV2).

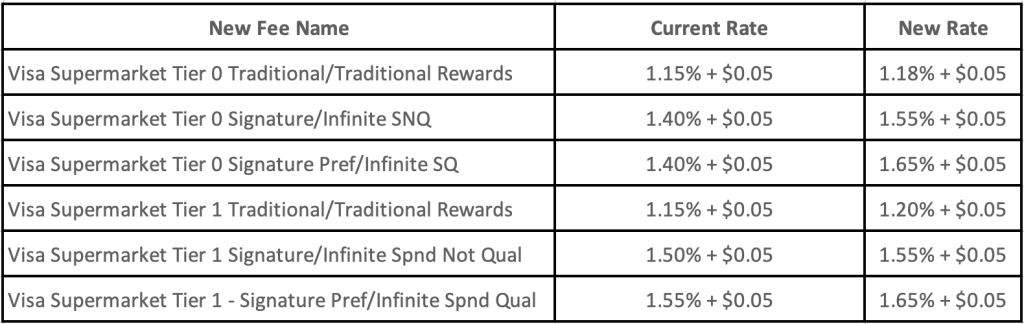

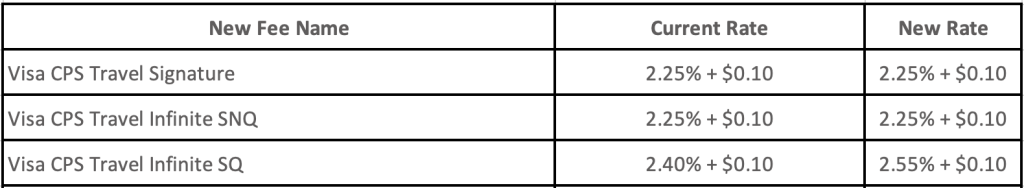

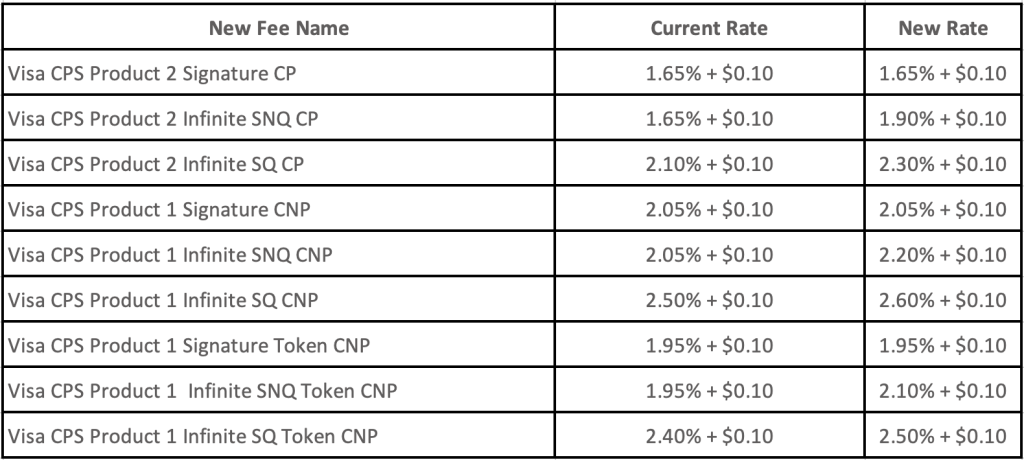

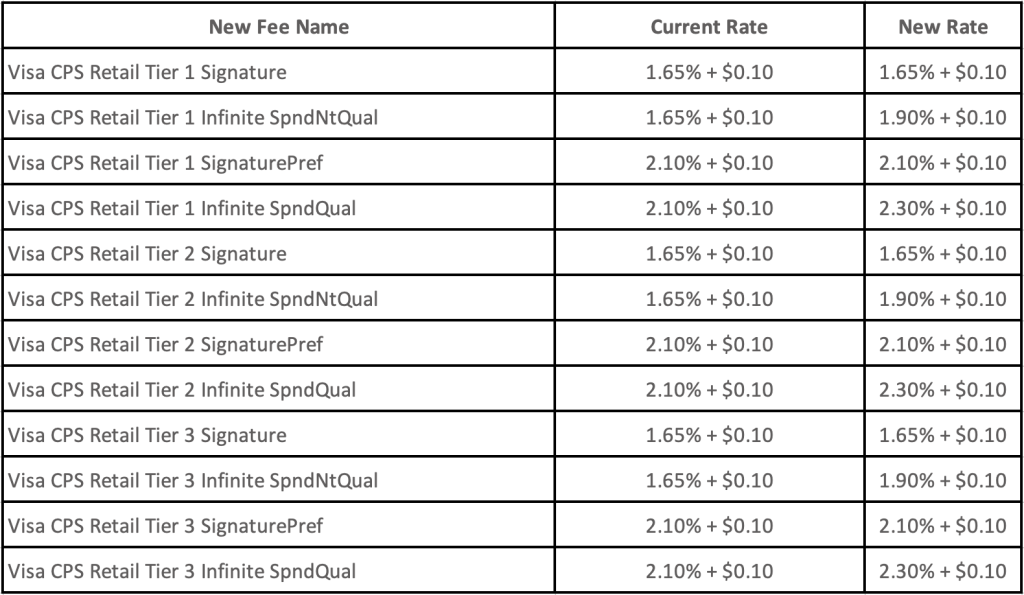

Effective October 13, 2023, Visa increased some interchange rates as follows:

New Rates and Fee Names Visa Performance Threshold Supermarket Tier 0 and Tier 1 Updated Interchange Rates

New Rates and Fee Names Visa Travel Updated Interchange Rates

New Rates and Fee Names Visa Product 1 and 2 Updated Interchange Rates

New Rates and Fee Names Visa Performance Threshold Retail Tier 1, 2, and 3 Updated Interchange Rates

Modifications to Small Merchant Interchange Program – US

Effective October 13, 2023, Visa introduced new fees/rates to support the existing Small Merchant Program. The fee programs will apply to Visa consumer credit transactions (card-present and card-not-present) for eligible merchants in the following segments: Restaurant, Taxi, Real Estate, Education, Healthcare, Advertising, Insurance, Services, and Telecommunications and Cable. These merchant segments will no longer qualify for existing card-not-present token programs. Instead, the new small merchant fee programs will apply.

To be eligible to participate in this program, a merchant’s annual domestic consumer credit sales cannot exceed $280,000, and the merchant cannot surcharge customers. If a surcharge fee is charged on a transaction, a higher interchange rate may be applied.

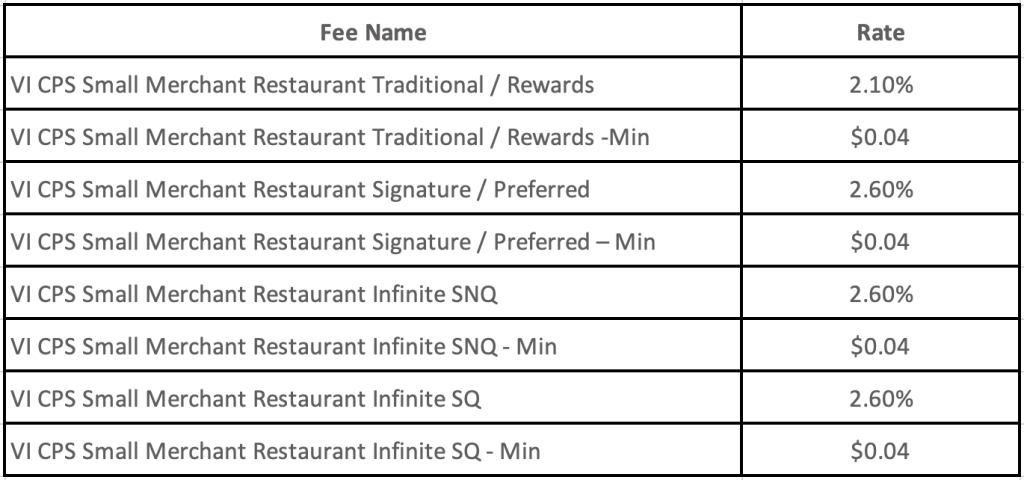

New Visa Small Merchant Interchange Rate and Fee Program for Restaurant

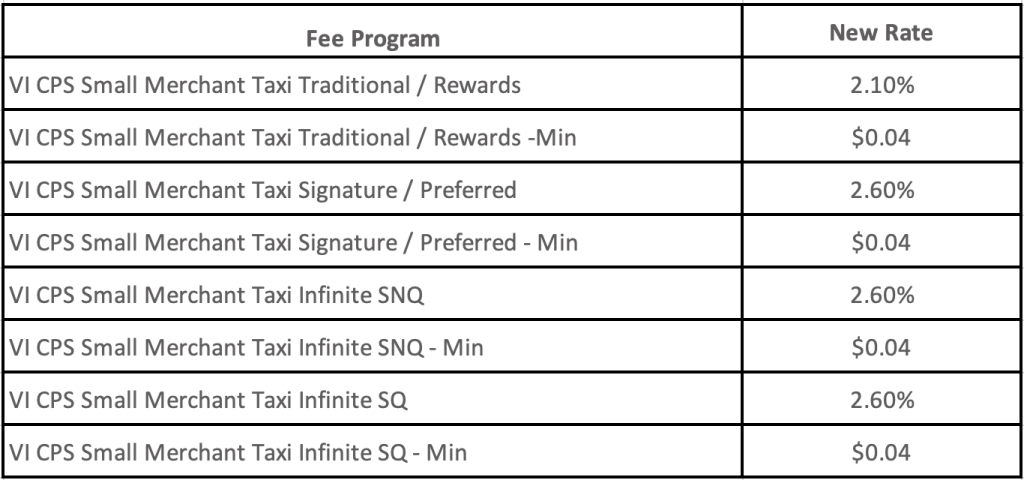

New Visa Small Merchant Interchange Rate and Fee Program for Taxi

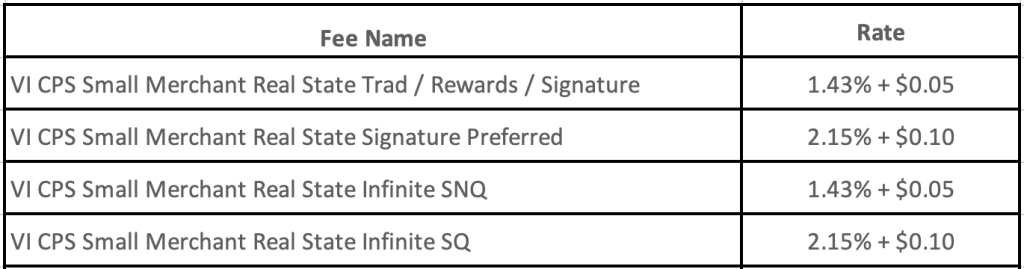

New Visa Small Merchant Interchange Rate and Fee Program for Real Estate

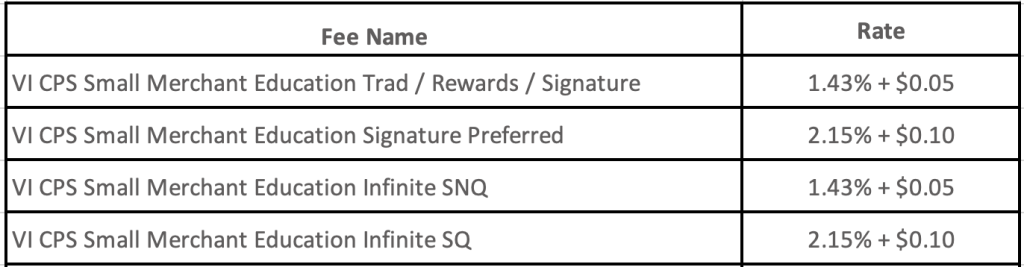

New Visa Small Merchant Interchange Rate and Fee Program for Education

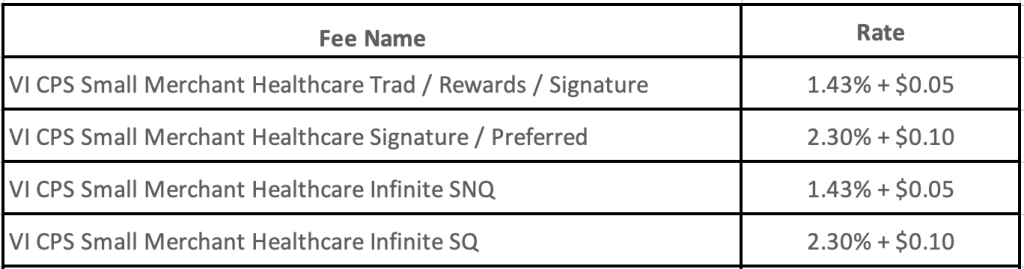

New Visa Small Merchant Interchange Rate and Fee Program for Healthcare

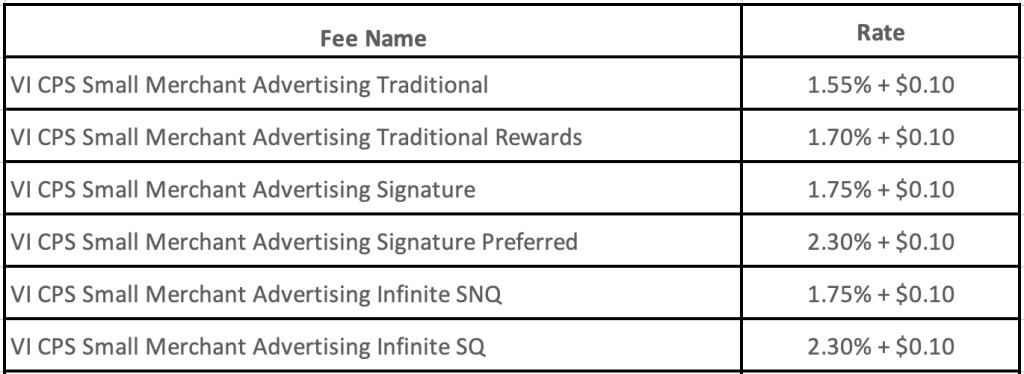

New Visa Small Merchant Interchange Rate and Fee Program for Advertising

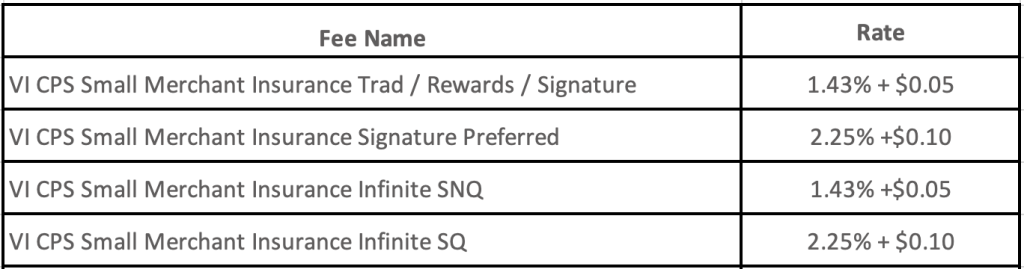

New Visa Small Merchant Interchange Rate and Fee Program for Insurance

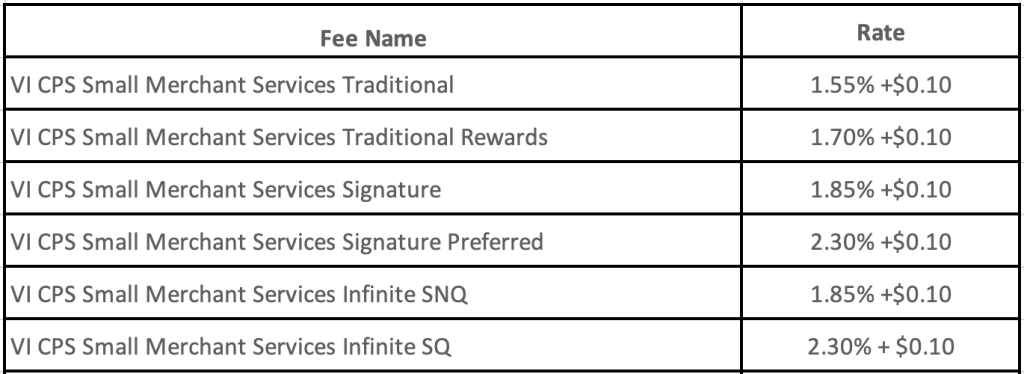

New Visa Small Merchant Interchange Rate and Fee Program for Services

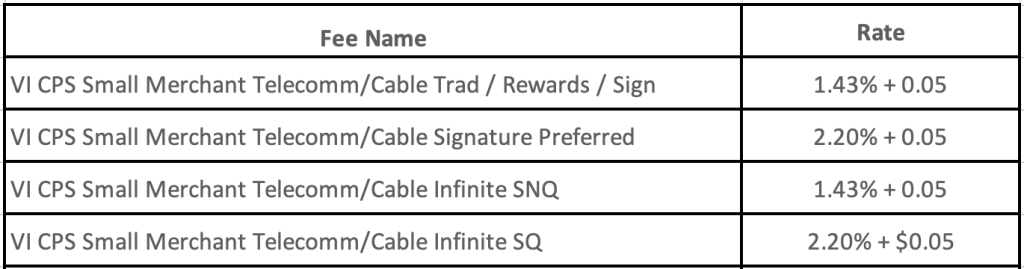

New Visa Small Merchant Interchange Rate and Fee Program for Telecommunications and Cable

Modifications to Interregional Interchange Programs – US

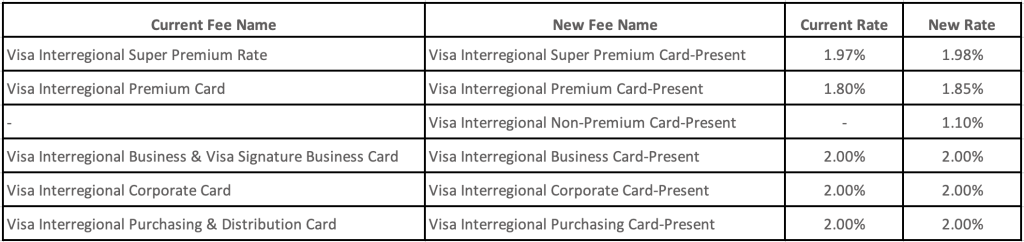

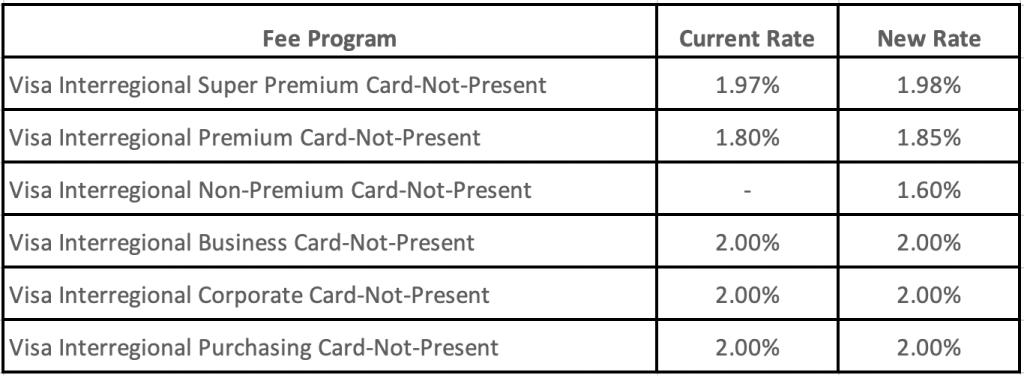

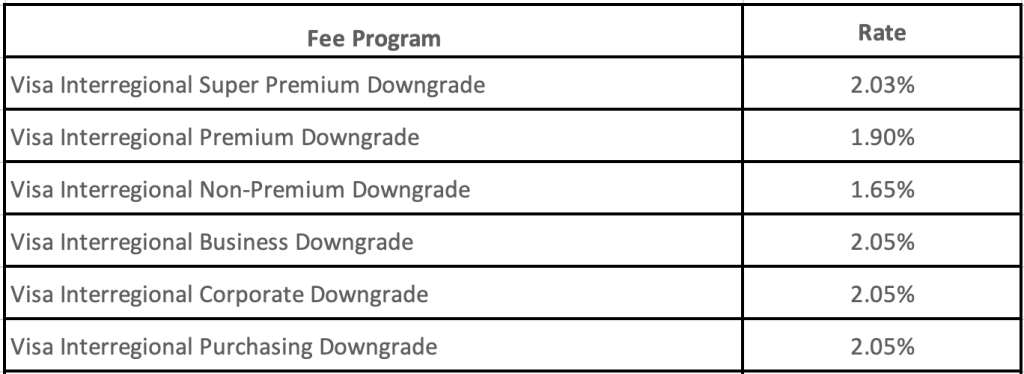

On October 13, 2023, Visa updated its interregional interchange program, eliminating some fees and introducing new names and rates for others. These fees apply when the merchant and issuer are in different countries.

The following fees for consumer transactions were discontinued:

- Electronic

- Acquirer Chip

- Issuer Chip

- Electronic Commerce Merchant

- Secure Electronic Commerce

The following fees were changed or introduced:

Visa Interregional Base Fee Programs1

Visa New Interregional Alternative Fee Programs2 for Visa Consumer and Visa Commercial, Including Business, Products

Visa New Interregional Downgrade Fee Programs for Visa Consumer and Visa Commercial, Including Business, Transactions

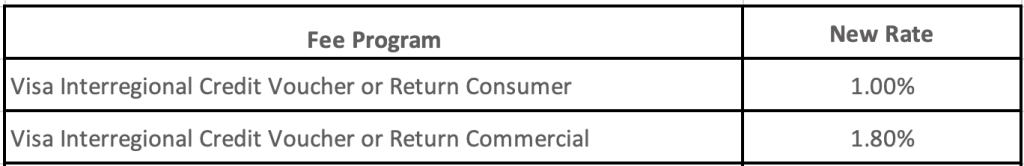

Visa New Credit Voucher or Merchandise Return Interregional Fee Programs

Visa Updated Interregional Standard Fee Program3

- Card present is now called Base fee.

- Card not present is now called Alternative fee.

- Visa and non-Visa interregional transactions that do not qualify for any other free program.

New Rules from Visa

Introduction of Monitoring Rule for Dispute Condition 10.4: Other Fraud— Card-Absent Environment Remedy – Global

On 27 April 2023, Visa announced the creation of the Visa Fraud Remedy Monitoring Program (VFRMP) to monitor merchant-provided qualification data submitted in response to the Dispute Condition 10.4: Other Fraud—CardAbsent Environment—Pre-Arbitration Processing Requirements. This was referred to as the Card-Absent Fraud Remedy rule. On October 14th, the monitoring program was added to the Visa Rules and renamed the Visa Fraud Dispute Monitoring Program (VFDMP).

Effective 14 October 2023, if the VFDMP identifies that data submitted by a merchant is invalid or falsified, both of the following will apply:

- The acquirer, merchant or their service provider will be contacted and notified of the merchant’s violation of Visa’s rules.

- Until the acquirer confirms in writing to Visa that the underlying issues have been addressed, the merchant / acquirer Bank Identification Number (BIN) involved in the violation will no longer be able to remedy a dispute by providing the required qualification data under the Dispute Condition 10.4: Other Fraud—Card-Absent Environment—Pre-Arbitration Processing Requirements. Data Element Requirements

The updated Visa Rules also contain requirements regarding qualification data provided under the Dispute Condition 10.4: Other Fraud—Card-Absent Environment—Pre-Arbitration Processing Requirements. For more information see Visa article regarding Introduction of Monitoring Rule for Dispute Condition 10.4: Other Fraud— Card-Absent Environment Remedy.

New Fraud Prevention Tool from Visa

Visa has introduced a new service – Account Name Inquiry (ANI). This service enables an online merchant to verify that the name provided by a cardholder matches the name held by their issuing bank. It provides an additional security check during card onboarding and pre-transaction checks. Performing a name verification can help reduce exposure to fraud and scams in subsequent Card Not Present (CNP) transactions. For more information see this Visa article on Account Name Inquiry.

In addition to introducing new fees, Mastercard is updating its Excessive Authorization Attempts TPE program in November.

New Fees

New Preauthorization Fee – US

Effective October 8, 2023, Mastercard introduced a preauthorization fee. For card present transactions the fee is 0.0075% (minimum of $0.01) and for card-not-present transactions 0.0125% minimum of $0.01.

MC Auth Optimizer NSF Fee – US

Effective October 2023, Mastercard introduced an Auth Optimizer NSF transaction fee of $0.02 which is billed when Mastercard provides intelligence for optimal retry times for insufficient fund declines on card not present transactions.

November 2023 – Excessive Authorization Attempts TPE Program Update

Starting November 1, 2023, merchants will incur fees if they retry a transaction more than 35 times in a 30-day rolling period. Any attempts in excess of the 35-attempt threshold will incur a $0.15 fee per authorization attempt.

This new threshold is in addition to the current 24-hour threshold under which merchants are charged a fee of $0.15 per authorization attempt if they exceed 10 attempts in a 24-hour period. Unique declines within a 24-hour period count towards the 30-day period threshold.

There have been no major changes from Discover Card.

If your business is looking to better manage your merchant account or reduce fees, we’re here to help. We fix and monitor your existing merchant account, and we bring that money back to you. No need to change processors or add a project to your team’s already hectic workload. Schedule a consultation today.

Verisave is a third-party cost-reduction firm specializing in merchant accounts and credit card processing fees.

Verisave is not a payment processor, and is not affiliated with any processors, card brands, or banks.

Verisave has more than 20 years of experience optimizing and monitoring the credit card processing industry.