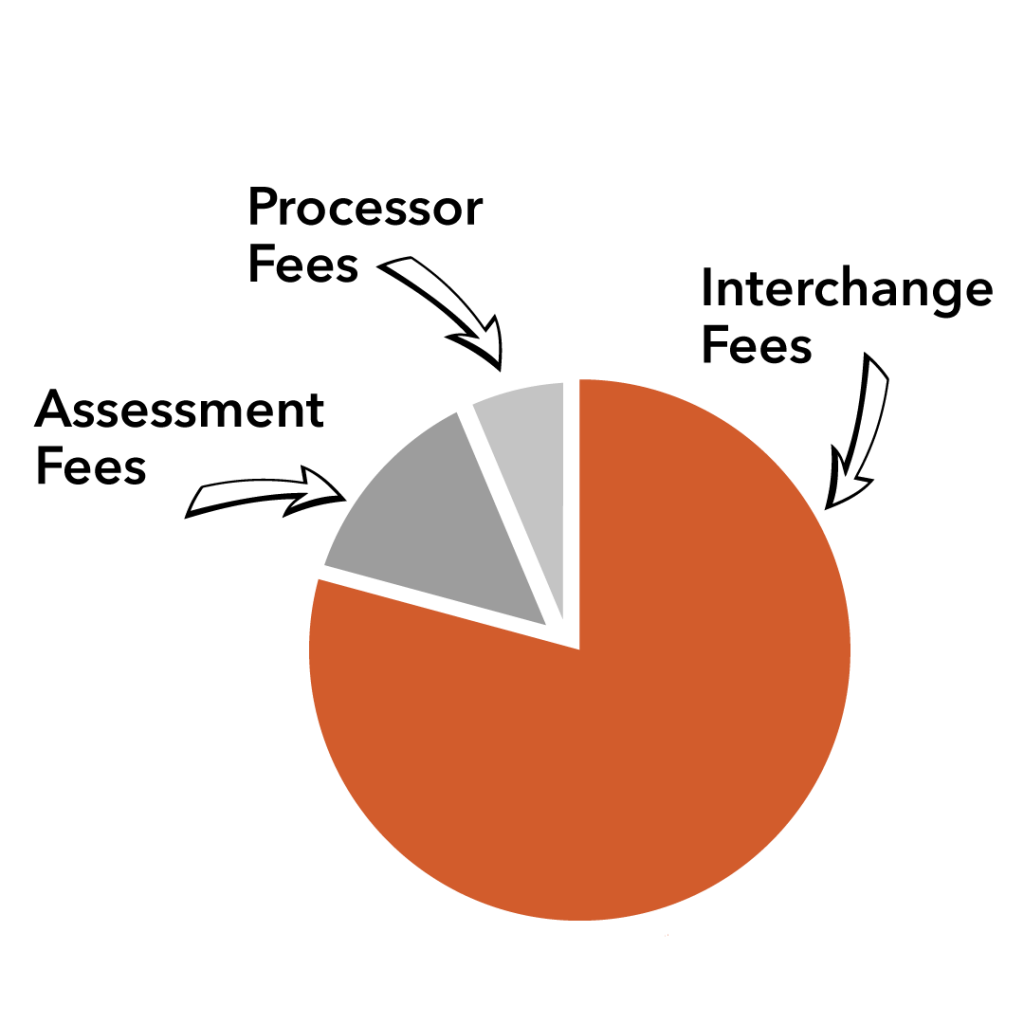

Whenever a business accepts a credit card payment, that business must pay a set of processing fees. These processing fees average about 3% of the transaction total, and are actually made up of numerous separate fees.

The largest portion of the processing fee total comes from Interchange Fees.

Interchange Fees are fees are charged by the issuing bank … the bank that originally issued the credit card to the merchant’s customer.

The issuing banks use this fee revenue to fund rewards programs, cash back, and points.

Many merchants are told: there’s nothing you can do to lower your interchange fees.

This is a myth.

Verisave is able to reduce Interchange Fees for their clients significantly.

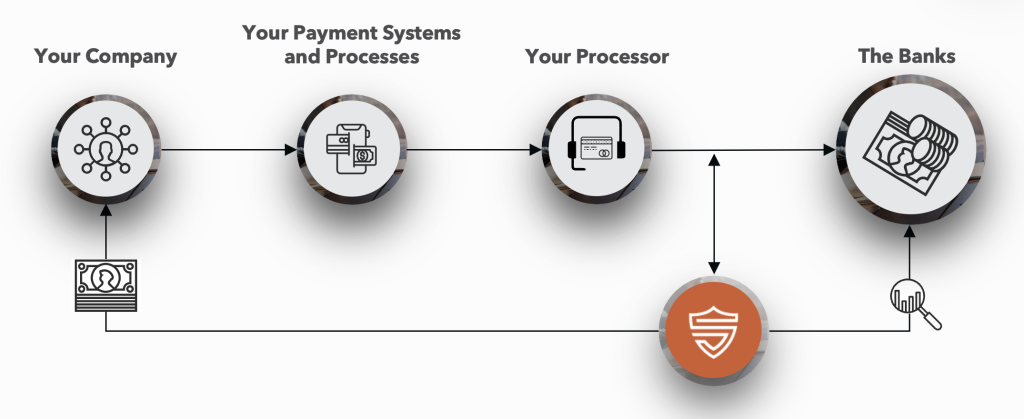

Verisave’s team understands the complex rules that govern processing and interchange fee rates, and uses these rules to your advantage. Verisave analyzes your current fee setup and makes numerous micro-adjustments to the back-end of the merchant account.

These adjustments optimize your interchange rates, ensuring you pay the lowest possible fees.

The Verisave team does all of the heavy lifting.

We fix and monitor your existing merchant account without the need to change processors, and we bring that money back to you.

Verisave offers cost-reduction, simplified. Without any time investment, disruption, risk, or upfront fees, we can easily bring 25%-35% of your credit card processing fees back to your bottom line.

No need to change processors, and no need to add a project to your team’s workload.

Strategy

We dissect and analyze every fee on your merchant account to find all viable savings tactics, re-classifications, and hidden discounts.

Optimization

We apply these tactics to your existing merchant account, implementing all savings for you. We do all of the work.

Monitoring

We monitor the account every month to ensure your fees do not increase over time, and that any annual rate updates are minimized or avoided.

It’s simple. Verisave clients boost their profits by reducing wasteful credit card processing fees through our expert optimization process.

Our work is entirely within the setup of the merchant account … we find errors, we fix them on the back end, and our clients return that extra money to their bottom lines. There’s no need to change processors.

Nothing else changes. There’s no disruption to any business practice or customer experience.

And we do all of the work.