An overview of the April 2024 credit card processing rate and rule changes.

Every year in April and October, the card brands update processing rates and rules. Verisave has been monitoring developments and summarized the rate and rule changes that will impact the broadest number of merchants.

Visa

New Fees

New Commercial Solutions Fee – US

In April 2024, Visa is expected to introduce a fee of 0.01% that will apply to POS transactions using Visa Business Solutions Products (e.g., business credit and purchasing cards).

Account Name Inquiry Fee Increase – US

In April 2024, Visa is expected to increase the Visa Account Name Inquiry (ANI) Fee from $0.05 to $0.10 for each account name inquiry performed as part of a zero-amount account verification transaction.

Visa Account Name Inquiry is a fraud prevention service introduced in October 2023 that enables an online merchant to verify that the name provided by a cardholder matches the name held by their issuing bank. For more information see this video.

New Interchange Rates

Based on information Verisave received in March, Visa had been planning changes to some interchange rates that were to take effect in April 2024. However, as of April 24, 2024, Visa has not published any new interchange rates. This may be related to the antitrust settlement announced March 24, 2024. Verisave will continue to monitor the situation and will update this post accordingly if there are any changes.

Mastercard

New Fees

Acquirer Brand Volume Fee (Assessment Fee) Increase – US

In April 2024, Mastercard is expected to increase the acquirer brand volume fee from 0.13% to 0.14% for transactions less than $1,000 and from 0.14% to 0.15% for transactions greater than or equal to $1,000.

New Mail Order/Telephone Order Fee -US

In April 2024, Mastercard is expected to introduce a new 0.015% fee on all cleared transactions defined as Mail Order/Telephone Order transactions.

Network Access and Brand Usage Fee (NABU) Extended – US

In April 2024, Mastercard is expected to extend the Network Access and Brand Usage Fee (NABU) of $0.0295 to apply to non-domestic authorizations as well as non-domestic collection-only and non-domestic sale/purchase and refund/credit transactions.

Digital Enablement Fee Revisions – US

In April 2024, Mastercard is expected to revise its Digital Enablement Fee structure for card not present transactions. For transactions greater than or equal to $1,000, a fixed rate of $0.40 will apply. For transactions less than $1,000 the prior fee of 0.02% with a minimum fee of $.02 will still apply.

American Express

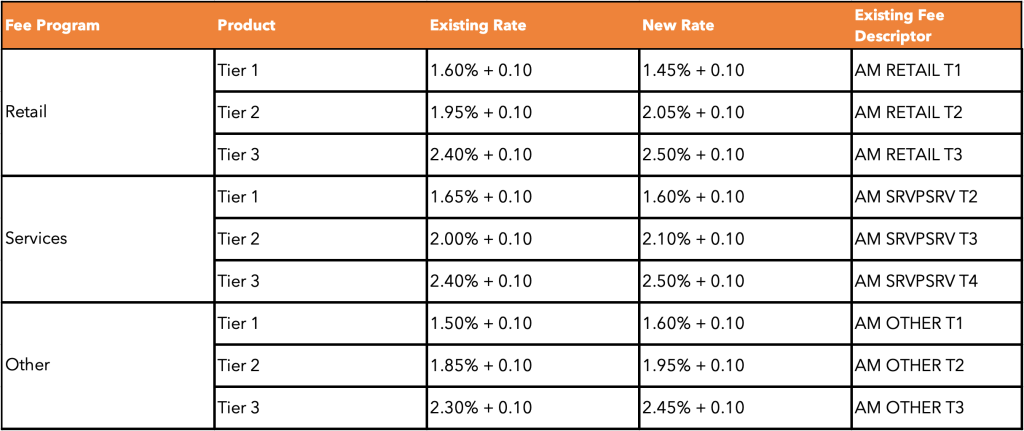

New Interchange Rates – Opt Blue

Effective April 12, 2024, American Express is expected to make the following interchange changes in its Opt Blue program.

Chargeback and Fraud Policy Changes

Chargeback Policy Update – CID Mismatch

Starting April 2024, merchants will be protected from card not present fraud chargebacks where the transaction contained an authorization approval and the merchant attempted to validate the CID and received a “no match” response. For more information, see this AMEX CID Policy Factsheet.

Updated Compelling Evidence Requirements: e-Commerce and Recurring Billing

Effective April 2024, AMEX has streamlined Compelling Evidence criteria to make it easier to understand and use. For more information, see AMEX April 2024 Merchant Policy Changes.

Discover

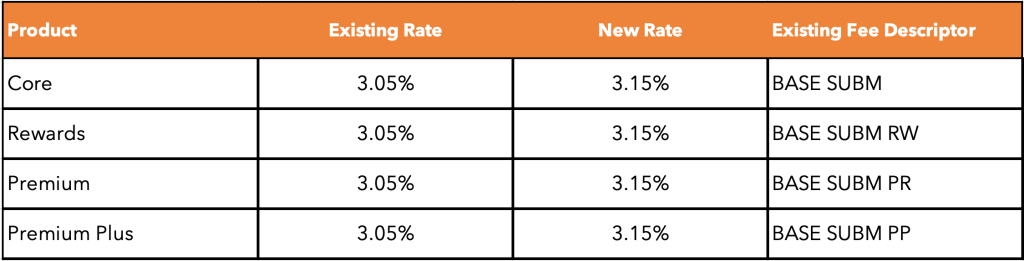

New Interchange Rates – Consumer Credit US

Effective April 12, 2024, Discover is expected to make the following interchange changes:

If your business is looking to better manage your merchant account or reduce fees, we’re here to help. We fix and monitor your existing merchant account, and we bring that money back to you. No need to change processors or add a project to your team’s already hectic workload. Schedule a consultation today.

Verisave is a third-party cost-reduction firm specializing in merchant accounts and credit card processing fees.

Verisave is not a payment processor, and is not affiliated with any processors, card brands, or banks.

Verisave has more than 20 years of experience optimizing and monitoring the credit card processing industry.