No matter which processor you select, you’ll pay processing fees every time you take a credit card payment. But with thousands of organizations offering credit card processing to merchants and business owners, how do you find the processor with the lowest possible processing fees? The answer may surprise you. You don’t. The bad news is that because credit card processor pricing is so complicated, it’s nearly impossible to comparison shop on fees alone. The good news is that in most cases, your processor doesn’t matter. That’s because there’s a much better way to reduce expenses than selecting a processor based on price.

Processor pricing is complicated and not always transparent, making it challenging to find the right processing company based on price. Here are the top five reasons why it’s nearly impossible to do a side-by-side comparison of processor fees.

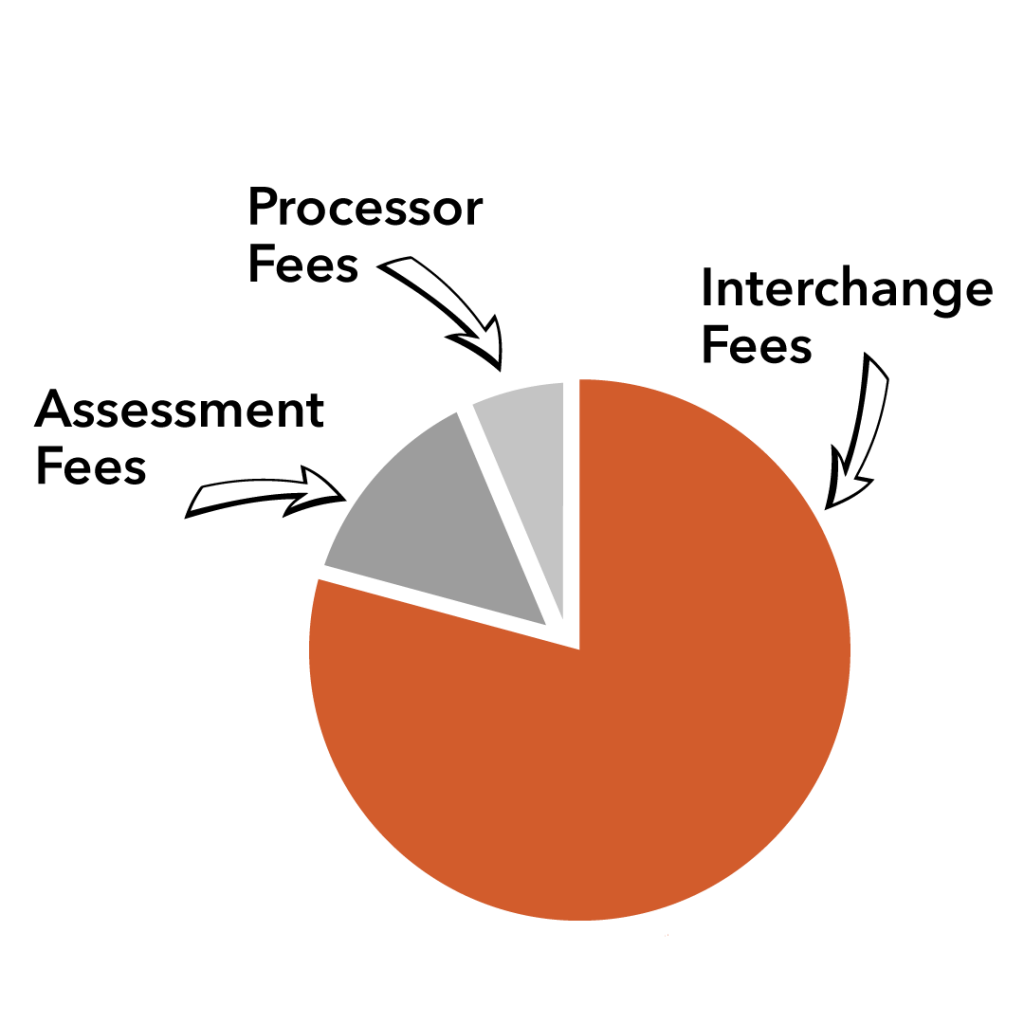

- Processing Fees: paid to the processor to cover the cost to complete the transaction, move the money, and send the fees to the banks and payment networks.

- Assessment Fees: paid to the credit card network such as Visa, MasterCard, Discover and American Express.

- Interchange Fees: paid to the financial institution that issued the card to your customer, primarily to fund cardholder reward programs.

5. Multiple Billing Methods

Behind every seemingly simple credit card swipe, one of multiple billing models will dictate what your business will pay in fees.

- Interchange-plus: the fees are all listed separately, so you see what you’re paying for each transaction. Many processors treat interchange and assessment fees as mere pass-throughs, although sometimes there will be a hidden markup that’s difficult to identify.

- Flat rate: the processing fees are uniform regardless of the transaction type and other factors that affect pricing behind the scenes. So, while these rates make it easier to predict your expenses, transactions tend to be more expensive.

- Subscription: a monthly fee is charged in addition to the individual transaction processing fees to incentivize the processor to work toward the lowest possible transaction fees.

- Value-added services: smaller businesses gravitate toward more expensive platforms like Square and Stripe for the ease of use and somewhat turn-key setup.

- Customer support: if your business operates online 24/7, shouldn’t your processor offer live customer support when you need it, not just during regular business hours?

- Banking relationships: if your bank offers processing services, selecting it as your processor may benefit the overall banking relationship positively.

- Technology requirements: some larger businesses may require complex integrations with ERP or other accounting systems. Not every processor is capable of every integration.

Verisave is a third-party cost-reduction firm specializing in merchant accounts and credit card processing fees.

Verisave is not a payment processor, and is not affiliated with any processors, card brands, or banks.

Verisave has more than 20 years of experience optimizing and monitoring the credit card processing industry.