Why Engage in a Merchant Account Audit?

Because managing a merchant account is incredibly complex.

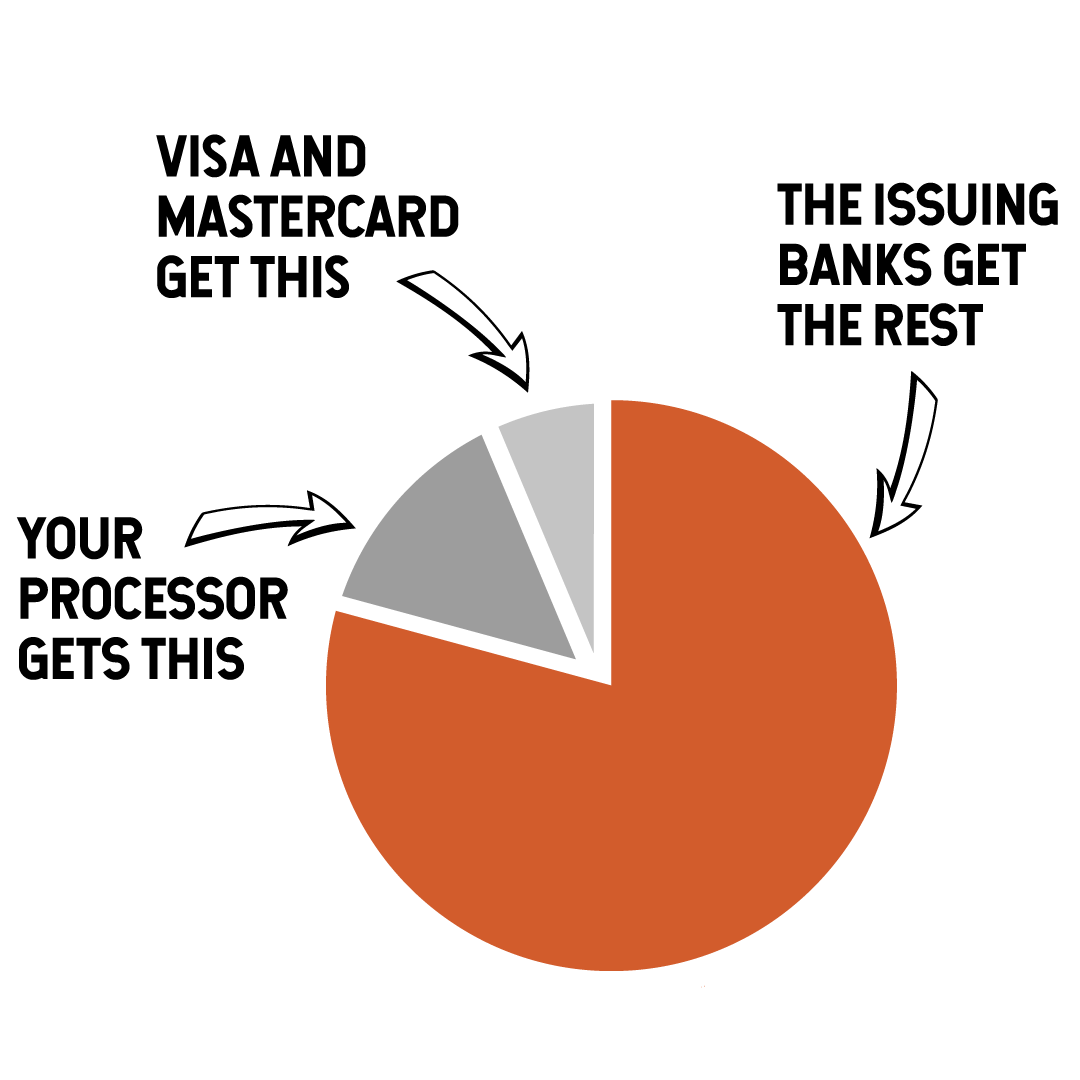

As you know: every time you accept a credit card payment from your customers, you pay a processing fee.

And as you probably suspect: you are being overcharged.

To understand how to fix it, you need to know where that money goes:

Your customer pays you.

Your processor keeps a portion …

And the issuing

bank keeps a

larger portion.

The Problem:

You have very little influence over these fees.

You have a direct relationship with your merchant processor.

But only a small amount of your fees go to the processor.

Most of your fees go to the bank that issued the credit card to your customer.

… and you have no leverage with that bank.

These are called INTERCHANGE FEEs.

What NOT to do:

In this industry, RFPs are a trap.

Renegotiating with your processor or finding a new one has little effect.

Here's why:

- Your processor doesn’t control interchange fees

- Your processor doesn’t have access to all available discounts

- Changing processors is a huge undertaking

- Most processors behave the same

- Often, any initial savings achieved are temporary and soon overcome by hidden or “pass-through” increases

The Solution:

An Independent Merchant Account Audit

Many merchants recognize they have very little transparency on their merchant account. They know they are losing money on credit card processing fees, but they don’t have the expertise in-house to identify where this is happening, or how to repair the merchant account.

Verisave audits achieve a number of key victories:

- You will have full transparency on your merchant processing fees

- Your account will be optimized to the lowest possible rate

- You will achieve all applicable industry or card-type discounts

- We can even lower your INTERCHANGE Fees

- This results in SUBSTANTIAL savings

- You can KEEP your existing processor

- It’s ridiculously EASY … Verisave does all of the heavy lifting