Are your clients overpaying on credit card processing fees?

Most likely, the answer is YES. Almost one-third of all processing fees are charged in error.

And correcting this can be time-consuming and ineffective … unless you have the right experts on tap. That’s where we come in.

Level 2 and Level 3 rates can significantly reduce your processing fees.

Level 2 and Level 3 rates are discounted credit card processing rates that can be achieved by gathering and submitting the proper data during a credit card transaction.

These rates are most applicable when you’re dealing with corporate, commercial, or government purchasing cards (“p-cards”).

To over-simplify: the more data you supply, the lower your fees.

So, why isn’t everyone doing it? Because collecting and submitting that data can be incredibly challenging, especially for busy finance teams who are already focused on other initiatives.

But it isn’t impossible. And it’s certainly worth the effort.

Level 2 and Level 3 Explained:

Why these discounts exist:

Many credit card processing fees were originally implemented to offset the cost burden of credit card fraud. Businesses like yours are incentivized to help the processing industry reduce fraud risk. By gathering more data from cardholders, you’re helping to minimize the chance of fraud. And you are rewarded with lower processing rates for doing so.

Why these rates are difficult to achieve:

To collect and submit the requisite data manually is not feasible. But the various components of your payments stack (payment gateway, integrations, ERP, etc.) are not typically built to automate this process. In order to implement the proper workflow, you would need access to extensive expertise. And it’s a big project.

The Solution:

Verisave has completed numerous Level 2 and Level 3 optimization projects, across a variety of industries. Most often, we are able to capture 100% of the available discounts for our clients. We have the expertise and the manpower to tackle this big project for you.

Ready to start capturing Level 2 and Level 3 discounted rates?

Let’s start with a conversation. Our consultants will determine if this is a good fit for you. If it is, we’ll complete an upfront analysis to determine the cost reduction opportunity.

You don’t pay us a dime unless we bring money back to you.

A few of our clients:

How it works.

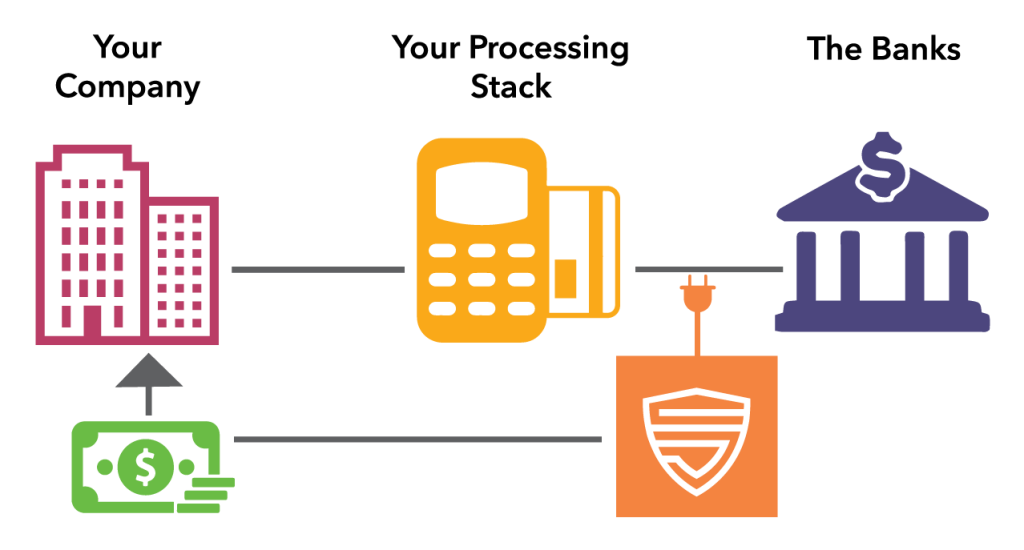

Verisave is NOT a processor. We work alongside your processor to optimize the back end of the merchant account. We work within the setup of the account to affect how information is passed to and from the banks. Our process ensures your rates are accurate and advantageous, without disrupting your current business practices or client experience.

We proactively analyze industry benchmarks, rate and rule updates, and discount programs so that your fees are as low as possible. And you only ever pay us as a portion of the savings we bring back to you … so you are guaranteed to retain more of your revenue.

Micro-adjustments are made to the back end of the merchant account to ensure proper and optimized processing rates.