USAePay for Credit Card Payment Processing

USAePay acts as a payment gateway provider for processing credit card payments. While many gateway providers also offer merchant accounts, USAePay does not. They have, however, developed a number of tools, hardware options, and proprietary software to help merchants with credit card processing.

To obtain USAePay as your gateway provider, you have to also work with one of their partners that offer merchant accounts. This includes major companies like Global Payments, Planet Payment, and WorldPay. You cannot sign up with USAePay directly. This is one of the reasons they can offer lower pricing to their customers.

USAePay will be a viable option for some businesses, but not many. While they provide hardware (POS systems), they’re generally in need of updates and are not compatible with the most recent smartphones and tablets.

If you are looking to work with USAePay to take advantage of their lower fees for gateway services, speak with a merchant account expert at Verisave. We have worked with multiple independent gateway providers across numerous industries and can help you determine if USAePay is a cost-efficient route for your business to take. If they aren’t, we’ll help you locate a less costly gateway provider to limit your monthly spending on merchant account-related fees.

Merchant Credit Card Processing Products & Services

USAePay acts as a payment gateway for merchants accepting credit card payments. They provide hardware and proprietary software and charge minimal fees.

USAePay PAYMENT GATEWAY – While USAePay doesn’t supply merchant accounts, they partner with other companies who do. Then, they act as the payment gateway for accepting credit and debit card payments, or check/eCheck payments, whether in person or via an eCommerce platform or virtual terminal.

USAePay MOBILE PAYMENTS – Accept EMV cards, as well as payments made with Apple and Android devices.

USAePay VIRTUAL TERMINAL – Turn an electronic device (desktop computer or handheld device) into a POS terminal with USAePay software.

USAePay eCOMMERCE SOLUTIONS – USAePay offers a selection of shopping cart options and integrations. Digital storefronts can set up recurring billing and omnichannel solutions, pairing their checkout service and data capture with multiple points of sale. This service has free tokenization and fraud tools, making it PCI compliant.

USAePay CHECK PROCESSING – Allow your customers to make payments via check when you use USAePay as your payment gateway.

USAePay HARDWARE (POS Systems) – USAePay offers hardware but most of it is fairly outdated, with their mobile hardware being compatible with iPhone 4 and older.

- Castle MP200

- Seiko RP-D10

- Castles Vega3000

- Shuttle Jack

- Paysaber Go

- Star Micronics TSP100

- Star Micronics MPop

- Woosim R240

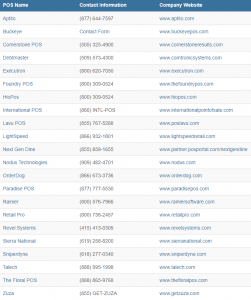

USAePay POS INTEGRATION – USAePay integrates with a large list of POS devices.

USAePay SHOPPING CART INTEGRATION – USAePay provides a massive list of virtual shopping cart providers that are registered with USAePay. Many popular shopping cart plugins are registered with them including WooCommerce and WordPress e-Commerce. Many of the companies on this list are also e-store builders. You can create a custom shopping cart experience to match the existing design and layout of your site.

USAePAY SECURITY AND FRAUD PROTECTION – USAePay uses tokenization to protect customer information during credit card transactions.

USAePay ACCEPT EMV PAYMENTS– USAePay offers hardware options for merchants to allow the use of EMV cards in their stores.

Speak with Verisave to see how we can lower your merchant account fees using USAePay. Traditionally, we will not require you to change processors, but if USAePay is not the best suit for your business and you can save on merchant fees by using another processor, then we will let you know. In any case, give us a call before making long-term commitments to any credit card payment processor.

USAePay System Integration

Theoretically, implementing USAePay systems is a simple process. But a majority of onboarding will depend on the merchant account provider. However, since USAePay integrates with so many available merchant account providers, shopping carts, and POS systems, they are an easy gateway provider to use with existing systems.

How Much Will You Be Paying For USAePay Credit Card Processing?

USAePay does not disclose pricing on their website. Fees for these services are determined largely by the third-party merchant account provider you’ll use to access USAePay’s gateway services. If you’re wondering which merchant account provider might offer you reasonable rates and reliable services for your particular field of business, speak with a merchant account expert at Verisave.

Verisave has worked with hundreds of companies to lower their overall merchant fees. We are confident our auditing experts can help you obtain fair rates for merchant account services. If you are already working with a merchant account provider, Verisave can still help you lower your overall monthly merchant fees. Contact us today to start this simple process with a free analysis of your current merchant account statement.

Contract Lengths For Using USAePay Payment Acceptance

Like pricing, contract lengths and any associated fees are determined by the merchant account provider working with USAePay to offer their gateway services. USAePay works with many well-known merchant account providers including TSYS, Global Payments, First Data, Chase Paymentech, and Vantiv (now Worldpay).

Working With USAePay’s Sales and Customer Service Reps

USAePay Customer Support – The website for USAePay offers lots of resources for support and troubleshooting. They even have a large library of video tutorials that can help you navigate a wide range of fraud issues, your recurring billing tools, and other transaction issues. Beyond their video tutorials, you can also access support with their phone line, ticket service, or email.

Unlike many companies in the credit card processing industry, USAePay’s website is full of information to help you understand the services and products they offer. Pricing is another story. You won’t find any information about fees and pricing on their website. For this info, you’ll have to figure out which merchant account provider to work with as they are the ones who set the rates for USAePay payment gateway services.

VERISAVE MERCHANT SERVICES REVIEW

USAePay for Credit Card Payment Processing

USAePay is a great gateway provider. But obtaining their services can be done by signing up for a merchant account with a number of different third-party providers. This is where the decision making gets more complex. When it comes to processing volumes, rates for processing, and additional services, there are a lot of factors to consider.

Verisave specializes in reducing merchant fees for companies of all sizes. Working with 500+ merchants to drastically lower their credit card processing fees has led our team of experts to develop proprietary benchmark data for tracking and comparing your rates and fees with current market trends. Based on our experience with numerous processors, gateways, and credit card providers and now having an invaluable data set of industry statistics – our clients gain control over the confusion of the credit card industry and save money. Watch the video below to see how our trusted process works:

Whether you are currently working with USAePay or if you are just exploring your options, our experience in the credit card processing industry lends a considerable leg up to merchants in any industry. Contact us today to start the process of uncomplicating your merchant statement and lowering your merchant fees.