TSYS (Total System Services, Inc.) for Credit Card Payment Processing

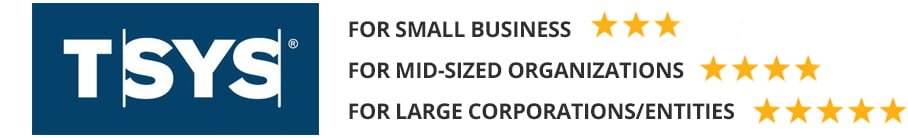

Verisave has worked with many companies using TSYS services to lower their overall merchant fees. TSYS is a credit card processor and merchant account provider catered to large corporations with high volumes of credit card processing. They process over one trillion dollars in credit card transactions every year. Small businesses to midsized companies may also use TSYS systems for credit card processing. Additionally some gateways are compatible with the TSYS payment platform.

You can access TSYS services directly through the company or work with a subcontracted ISO.

Your experience will vary depending on who you go through to obtain these services. Some ISO companies can offer lower rates or perhaps better customer service, while others may be more willing to take advantage of their customers.

Products & Services Offered by TSYS (Total System Services, Inc.)

TSYS MERCHANT ACCOUNTS – TSYS provides merchant accounts, allowing merchants to accept credit card payments from their customers. Because they offer merchant accounts and handle the processing, they can be a one stop shop for customer service needs. .

TSYS PAYMENT GATEWAY – For eCommerce merchants, TSYS provides the necessary payment gateway for authorizing credit card payment transactions. Merchants can utilize TSYS services including retail-card present transaction fees and recurring payment tools that are PCI compliant and PA-DSS certified.

TSYS POS TERMINALS – TSYS offers many POS options for merchants. Their software uses a Windows-based PC. Merchants can choose from the following credit card terminals listed below:

Virtual Terminal – TSYS offers the software necessary to turn your desktop computer into a virtual terminal. Their virtual terminal is not EMV-compliant.

Verifone VX520

Ingenico iCT250

Ingenico iCT220 CTL

Verifone VX 680

Ingenico iWL250

Ingenico iWL250 3G-GPRS

Verifone VX 805

Ingenico iPP320 PIN pad

Ingenico iPP310 PIN pad

MagTek Dynamag Swiper

Epson ReadyPrint T20 Thermal Printer

mPOS (TSYS Tablet Solution)

TSYS ONLINE CREDIT CARD PAYMENT PROCESSING – TSYS has many merchant solutions for accepting credit card payments online.

- WebPASS – Their secure virtual payment acceptance solution.

- MultiPASS – If you have your own POS system, integrate it with a TSYS processing platform using the MultiPASS merchant solution. This allows you to use your current hardware/software. It may not be available for all existing POS systems.

- TSYS Hosted Payment – This merchant solution allows you to use a TSYS payment platform without interrupting the look and feel of your custom website and branding.

TSYS online credit card processing solutions come with security and fraud prevention, accepts all types of payments, and provides reporting tools for your business management needs.

TSYS MOBILE CREDIT CARD PAYMENT PROCESSING/mPOS – Businesses can accept credit card payments with their mobile device (smartphone or tablet). Their solution combines a card reader with an app for your mobile device (works with Android and iOS). These solutions do not offer support for EMV or NFC payments.

[su_row class=”s-row”][su_column size=”1/2″] [/su_column]

[/su_column]

[su_column size=”1/2″] [/su_column][/su_row]

[/su_column][/su_row]

TSYS WIRELESS PAYMENT PROCESSING – TSYS has developed a merchant solution for accepting credit card payments anywhere you cannot access a wifi connection.

TSYS TELEPHONE PAYMENT PROCESSING – TSYS has developed a merchant solution for accepting payments via any telephone. It is called DIALPAY and uses your touch tone phone to run credit card transactions. You call a toll free number and follow the prompts, entering info using your dial pad as you go. This solution is useful for merchants who are in need of it, but it is a time-consuming way to process payments. With DIALPAY, you can also perform credit card refunds, authorization-only transactions, and void transactions.

TSYS MULTIPLE PAYMENT ACCEPTANCE SOLUTIONS – Using TSYS, merchants can accept the following forms of payment from their customers:

- ACH Payments

- Checks and eChecks

- Credit Cards

- Debit Cards

- Digital Wallet

- EBT (Electronic Benefits Transfer)

- Prepaid Cards

TSYS is a large, secure, and well-established credit card processing company in the merchant services industry. If you are currently working with TSYS, Verisave auditors can help you to lower your merchant fees with TSYS Merchant Solutions. Having worked with hundreds of merchants to significantly reduce their overall merchant fees, we have developed proven strategies for obtaining savings with the TSYS payment platform.

TSYS (Total System Services, Inc.) UI/System Integration

TSYS has developed tools for merchant services that help to organize and streamline your credit card processing. They work as your merchant account provider, payment gateway, and processor. Because they are a direct processor, you can avoid the complications associated with using multiple companies for the various merchant services needed to accept, authorize, and disperse credit card payments.

TSYS integrates with many POS terminals. You may obtain a POS terminal through TSYS or implement their TSYS hosted payment solution to continue using an existing POS terminal you already own. This is a useful tool for merchants who wish to integrate TSYS services into an already existing payment processing system.

How Much Will You Be Paying For TSYS Services?

TSYS does not post pricing for their services on their website. If you were to find quotes anywhere online, keep in mind that TSYS can operate with a tiered pricing plan, like many major merchant account providers in the US. This means that you are likely to not receive the same pricing as something you have seen advertised by an ISO or current customer.

Verisave can help you to obtain significant overall savings when you speak with our merchant account auditors. Our experience in the credit card processing industry combined with our benchmark data gives us a leg up when working with any payment processors.

TSYS Contract Length

Contract lengths for TSYS are typically 3 years. They also automatically renew every year after that unless you manually opt out of automatic renewal. They usually have an early termination fee of $250.

TSYS (Total System Services, Inc.) Sales and Customer Service Reps

On the TSYS website, you will not find any disclosure of pricing. For this, you will have to speak directly with a sales rep. Upon calling TSYS, you will speak with an in-house representative. TSYS. Speaking with the sales rep takes a few minutes and they will ask for personal information concerning your business, credit card processing volumes, and more, to determine which pricing plan your business best fits into. They are relatively easy to work with.

Customer service and tech support for TSYS is known to be somewhat difficult to work with. They can be reached by email and telephone 24 hours a day, 7 days a week. For technical support and customer service, we recommend calling during regular business hours. After that, you are likely to speak with an outsourced call center which might have more difficulty helping you with your problem.

TSYS (Total System Services, Inc.) Online Reviews

Positive Reviews: Generally, customers agree that TSYS offers a wide range of support for varying types and sizes of companies with their customizable packages. Their security and anti-fraud measures are highly reliable. TSYS was just recently chosen as one of Ethisphere Institute’s “World’s Most Ethical Companies” for 2018.

Negative Reviews: Most negative comments about TSYS revolve around 3 topics: the early termination fee, billing issues, and terminal lease pricing. If you have the early termination fee jargon stricken from your contract when you sign up for TSYS services, it is possible they may still charge this fee if you leave TSYS before your contract expires. That is why it is important to save this documentation so you can have the early termination fee retracted if it is charged. Once your account has been closed, it is possible you may continue to see monthly charges from TSYS. This was another common complaint from past customers. It most cases, refunds were applied and the problem was corrected. When leasing terminals from TSYS, make note of non-cancellable lease contracts. These are typically 48-month terms. If you terminate TSYS services early, you will still maintain a terminal lease until the contract expires. Leasing tends to amount to thousands of dollars while purchasing can be much less expensive in the long run.

Verisave Merchant Services Review

TSYS (Total System Services, Inc.) for Credit Card Payment Processing

Overall, TSYS is a great option for many business owners in need of credit card payment processing. This large company has sufficiently worked through many hang ups that smaller processing companies are still navigating. Working with TSYS gives you a wider range of terminals to choose from, they are easier to integrate with existing systems, and their prices are relatively fair.

If you are interested in working with TSYS, Verisave merchant account experts are eager to assist you in the onboarding processes. Verisave can help you to control costs with TSYS. Our proprietary data, developed by working with over 500 companies using credit card processing services, gives you access to more savings opportunities and transparency.

Companies currently working with TSYS can recognize more savings as well when working with Verisave. See how our process can be applied to your business by watching this short video:

To get started, submit your most recent merchant account statement for a fee analysis. There is NO RISK in partnering with Verisave – you approve of our plan before it is implemented. You remain in total control of your merchant accounts while a Verisave consultant does all of the heavy lifting. Capturing savings will be our full responsibility and not another task on your list of things to do.

Verisave works on a gain/share basis, you only pay us our share for creating these savings AFTER you have pocketed the money. Once we have successfully reduced your overall merchant fees, Verisave will continue to audit and monitor your merchant statement each month ensuring the saving initiatives stay in place. We will continue to identify additional savings opportunities on your behalf. Contact Verisave to find out how you could benefit frm our merchant account auditing services.